For TheOneLawFirm.com

“A $300,000 Penalty for a $16,000 Account? That’s Not a Fine — That’s a Warning Shot.”

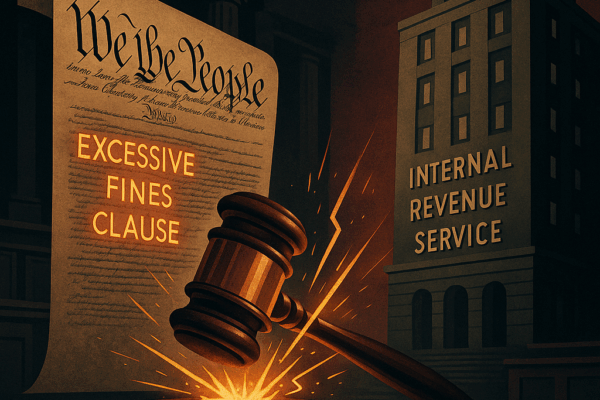

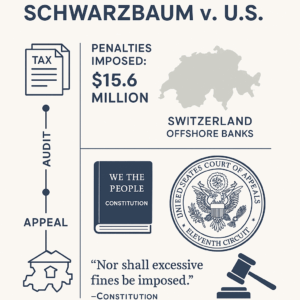

In late summer 2024, a quiet but seismic shift occurred in federal tax enforcement. The Eleventh Circuit handed down its decision in United States v. Schwarzbaum, a case involving multimillion-dollar FBAR penalties — and for the first time, a federal appellate court held that the Eighth Amendment’s Excessive Fines Clause applies to willful reporting violations for foreign bank accounts.

That’s right. A clause forged to rein in medieval punishments is now being deployed in the modern world of offshore compliance. For tax attorneys and compliance professionals, the implications are enormous.

Welcome to the post-Schwarzbaum era — where penalties have limits, and the Constitution might just have your back.

The Billionaire Who Wouldn’t File

Isac Schwarzbaum wasn’t your average FBAR defendant. The German-born, naturalized U.S. citizen controlled dozens of Swiss and Costa Rican accounts, some holding millions. From 2007 to 2009, he failed to file required FBAR forms — the foreign bank reporting forms triggered when aggregate balances exceed $10,000.

When the IRS came knocking, it didn’t come lightly.

Originally assessing him $35 million in penalties, it eventually settled on a “discounted” judgment of about $12.5 million. Schwarzbaum refused to pay. The government sued. He lost at trial — and then he appealed, launching a constitutional attack few had successfully pulled off.

The IRS’s Nuclear Option: FBAR Penalties

To understand what’s at stake, consider the following:

| Violation Type | Penalty Cap |

|---|---|

| Non-Willful | $10,000 per account per year |

| Willful | Greater of $100,000 or 50% of account balance per year |

That last row is key. For willful violations — even reckless ones — the IRS can impose 50% penalties on the account’s value per year. That means a person with a $4 million offshore account could face $2 million per year in fines, even if no taxes were actually owed.

Multiply that across three years. Then across multiple accounts. You get the picture.

“These penalties are not about restoring losses. They’re about making an example.”

— Tax litigator, quoted anonymously

The Eleventh Circuit’s Bombshell: FBAR Fines Are Actually “Fines”

For decades, courts avoided treating FBAR penalties as fines. Instead, they viewed them as “remedial” — designed to reimburse the government for enforcement efforts.

But in Schwarzbaum, the Eleventh Circuit said otherwise.

In a sharply reasoned decision, the court ruled that FBAR penalties — especially the willful kind — serve a punitive purpose. And if they’re punitive, they fall under the Excessive Fines Clause.

Here’s why that mattered:

Why FBAR Penalties Crossed the Line

-

They don’t match any actual loss the government suffered.

-

They’re triggered by culpability (willfulness, not mere negligence).

-

They can be financially ruinous, easily exceeding 100% of the account value over time.

-

Congress openly designed them to deter — a classic indicator of punishment.

The court’s bottom line? Even civil penalties can be fines under the Constitution — and some FBAR penalties are simply too much.

A Case Brief in One Glance

| Case Name | United States v. Schwarzbaum, 22-14058 (11th Cir. 2024) |

|---|---|

| Issue | Are FBAR penalties subject to the Excessive Fines Clause? |

| Holding | Yes — penalties are partially punitive and thus “fines.” |

| Result | $300,000 in penalties struck down as excessive; $12.2M upheld. |

| Impact | Breaks with other circuits, opens door to more Eighth Amendment challenges. |

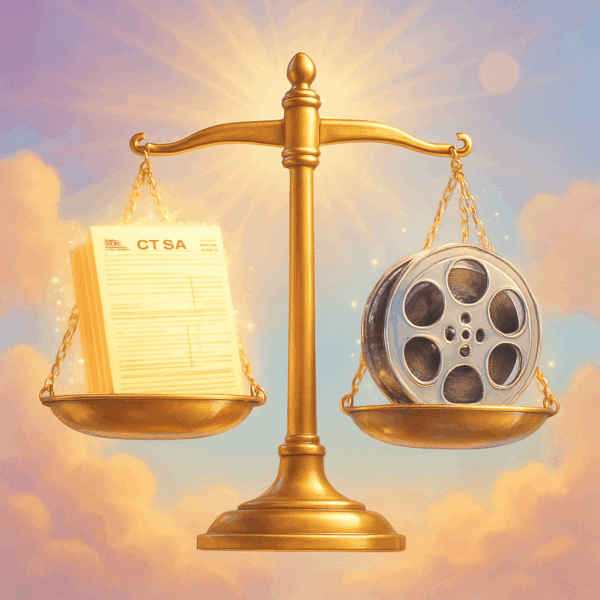

Account-by-Account Justice

Rather than blanket rulings, the Eleventh Circuit took a granular approach — analyzing each FBAR violation separately.

Take the Aargauische Swiss account. It held under $16,000, yet the IRS imposed $100,000 per year in penalties for 2007–2009. That totaled $300,000 — almost six times the account’s value.

The court struck it down.

But for the big-ticket accounts — some with balances in the millions — the court upheld the 50% penalties, affirming that severity alone doesn’t equal excess. Context matters.

“We have no trouble imagining FBAR fines that are clearly excessive.”

— Eleventh Circuit Panel, Schwarzbaum

A Circuit Split Emerges

Before Schwarzbaum, the First Circuit in United States v. Toth held that FBAR penalties weren’t fines at all. They were “civil” and thus outside the Constitution’s scope.

The Eleventh Circuit disagreed — and took the rare step of citing a Supreme Court dissent, from Justice Gorsuch no less, who lambasted the Toth outcome and warned of constitutional evasion.

Now we have a split:

-

First Circuit: No constitutional protection from FBAR penalties

-

Eleventh Circuit: Some FBAR penalties can be unconstitutional fines

That’s Supreme Court bait.

What This Means for the IRS — and Everyone Else

What This Means for the IRS — and Everyone Else

The fallout from Schwarzbaum is already reshaping tax enforcement strategy. Here’s how:

1. IRS Discretion May Shift

Agents may now hesitate to apply the full 50% penalties in smaller-balance cases — especially when the minimum $100,000 per violation feels disproportionate. Expect more calibrated penalties and settlement offers.

2. New Defense Tools

Taxpayers and their counsel can now challenge FBAR penalties as excessive in some jurisdictions — a defense that didn’t formally exist in many circuits just two years ago.

3. Voluntary Disclosure Looks Even Smarter

Schwarzbaum actually entered the IRS voluntary disclosure program — and then opted out. Big mistake. Practitioners will likely use this case as a teaching moment: disclose before the IRS finds you. The penalties are still brutal. Don’t gamble on the Constitution to save you.

What Comes Next?

The Schwarzbaum ruling has set the stage for a national showdown. Unless Congress steps in to reform the FBAR penalty structure — or the Supreme Court resolves the split — we’re living in a divided legal landscape.

-

In some circuits, massive FBAR penalties are immune from constitutional review.

-

In others, they’re open to Eighth Amendment challenges.

For now, the fate of a taxpayer with unreported foreign accounts may depend on something as arbitrary as where they live — or where the IRS chooses to sue them.

Conclusion: A Fine Line Between Enforcement and Punishment

United States v. Schwarzbaum is more than just a tax case. It’s a constitutional reckoning for an era of aggressive financial penalties. It tells the IRS: go ahead and enforce the law — but don’t cross the line into tyranny.

For tax professionals, it’s a powerful reminder that proportionality still matters, even in the complex web of offshore compliance.

As for Schwarzbaum? He may still owe $12.2 million — but he’s drawn a line in the sand. And for now, at least one federal court agrees.

Endnotes

-

United States v. Schwarzbaum, 22-14058 (11th Cir. Aug. 30, 2024).

-

Bank Secrecy Act (31 U.S.C. § 5314 et seq.); FBAR penalty guidelines are codified under 31 U.S.C. § 5321(a)(5).

-

The maximum FBAR penalty for willful violations is the greater of $100,000 or 50% of the account balance per violation.

-

United States v. Toth, 33 F.4th 1 (1st Cir. 2022).

-

Justice Gorsuch, dissent from denial of certiorari, Toth v. United States, 598 U.S. ___ (2022).

-

Baker McKenzie, “Eleventh Circuit Rules Willful FBAR Penalties Are Fines,” Aug. 2024, analysis summary.

-

Meadows Collier LLP, “Will the Excessive Fines Clause Now Curb the IRS?,” Tax Controversy Insights, Sept. 2024.

-

Miller Canfield, “FBAR Penalties and the Constitution: Where We Go After Schwarzbaum,” Sept. 2024.