Free to Create, Free to Discriminate? Inside the 303 Creative Ruling Shaking Constitutional Law

On the last day of the Supreme Court’s 2023 term, a controversy over a wedding website that didn’t even exist set a pivotal precedent. In

Tax and revenue law is one of the most intricate and dynamic areas of legal practice. Tax laws are constantly evolving, driven by shifts in policy, changes in government regulations, and new rulings from tax courts. For legal professionals working in this space, understanding how past cases have been handled is crucial for predicting future outcomes, refining legal strategies, and ensuring compliance. Case studies are invaluable resources in this process, providing a comprehensive view of how tax and revenue laws are applied in real-world scenarios.

At The One Law Firm, we recognize the power of case studies to illuminate the complexities of tax and revenue law. By diving deep into historical and recent tax cases, legal practitioners can gain insights into best practices, strategies that succeeded (or failed), and how different approaches might apply to their own cases. This article will explore why case studies are essential in tax and revenue law, how reviewing these case studies can improve decision-making, and how The One Law Firm’s blog will foster a community for ongoing professional development in this field.

Tax and revenue law is characterized by its technicality and its direct impact on both individuals and businesses. Every decision in this field is not just about the law itself but also about understanding the consequences of those decisions on a financial and operational level. Case studies serve as powerful teaching tools, allowing lawyers to analyze previous outcomes and gain a better understanding of the potential ramifications of different legal approaches.

Why Case Studies Matter

Navigating Complex Tax Laws

Tax law is often seen as a maze of statutes, regulations, and rulings. Case studies allow practitioners to study how courts, administrative bodies, and tax professionals have navigated these legal complexities. By reviewing detailed examples of similar situations, tax lawyers can gain insight into how various legal provisions interact, how tax authorities interpret those provisions, and how to craft successful strategies for their own clients.

Example: The landmark case of South Dakota v. Wayfair revolutionized the application of sales tax on e-commerce transactions. By examining the rulings, tax professionals can better understand the judicial reasoning behind such changes and apply it to similar cases involving online sales tax compliance.

Understanding Tax Court Rulings and IRS Procedures

The relationship between tax law and the government, particularly the IRS, makes it essential for tax lawyers to have a solid understanding of case outcomes. Case studies focusing on tax court rulings provide insight into how judges interpret tax laws and the IRS’s procedures, offering strategies for challenging or defending against tax audits, penalties, or disputes.

Quote: “In tax law, case studies help lawyers anticipate how tax courts might rule in similar disputes, enabling them to craft arguments that are better aligned with judicial reasoning.” — James Trenton, Partner at Tax & Revenue Law Associates.

Learning from Industry-Specific Cases

Tax laws differ vastly across industries. For example, the tax treatment of real estate transactions is different from the tax treatment of financial securities, and the tax obligations of nonprofit organizations are distinct from those of for-profit businesses. By reviewing industry-specific case studies, tax professionals can learn the nuances of applying tax law in a specific context, improving their ability to address clients’ unique tax challenges.

Example: Case studies involving the tax treatment of partnerships or LLCs can help tax professionals understand the complexities of pass-through taxation and how to structure deals in compliance with the IRS’s rules.

For tax professionals, the ability to make informed, strategic decisions is essential for both client success and professional growth. By reviewing case studies, legal professionals can refine their decision-making skills in several key areas:

Predicting the Outcome of Tax Disputes

One of the biggest challenges tax attorneys face is predicting how courts will rule in cases involving complex tax issues. By studying case studies, practitioners can identify patterns in how courts have previously handled similar issues. These insights can be invaluable for advising clients on the likelihood of success in a dispute and how to adjust their strategies accordingly.

Enhancing Tax Compliance Strategies

Tax compliance is a major concern for both businesses and individuals. By analyzing case studies where clients faced tax audits or penalties, tax professionals can better understand the common pitfalls and challenges that lead to compliance issues. This allows them to proactively address potential problems, ensuring clients remain compliant with tax regulations.

Quote: “Looking at case studies has allowed us to refine our compliance strategies. It’s not just about knowing the law; it’s about anticipating the challenges that may arise when dealing with tax authorities.” — Rachel Walker, Senior Tax Counsel at National Tax Consultants.

Mitigating Risk through Strategic Planning

A key part of tax law involves minimizing risk—whether it’s preventing a client from triggering an audit or ensuring that a business maximizes deductions without raising red flags. Case studies allow practitioners to review what has worked in similar cases and help mitigate the risks in their own client’s cases. A comprehensive understanding of past mistakes and successful strategies can lead to more informed planning.

Refining Litigation Strategies

Tax litigation, whether it involves defending against IRS actions or challenging tax regulations, requires a delicate balance of knowledge, strategy, and negotiation. By reviewing past cases, tax professionals can learn how to approach litigation, understand the tactics that have been successful in the past, and avoid the mistakes that led to failed attempts.

While case studies are an essential tool for tax professionals, they must be used effectively. Here are several best practices for leveraging case studies in your practice:

Contextualizing the Case

A tax case doesn’t exist in a vacuum. To fully understand its relevance, it’s important to consider the specific facts, legal issues, and procedural history that led to the ruling. By placing case studies within their broader context, tax professionals can draw more relevant lessons and apply them to their own cases.

Evaluating the Regulatory Environment

Tax law is highly influenced by regulatory changes, including changes in tax policy and enforcement practices. Case studies should be reviewed in light of current regulations, as the legal landscape can shift rapidly. Comparing how tax law has evolved in similar cases can help predict how future cases may be decided.

Collaborating with Other Professionals

Tax law does not operate in isolation. By collaborating with other professionals, such as accountants, financial advisors, and business consultants, tax lawyers can gain a more comprehensive understanding of the case at hand. Working in a multidisciplinary team helps to uncover different angles and ensure that all aspects of a tax issue are properly addressed.

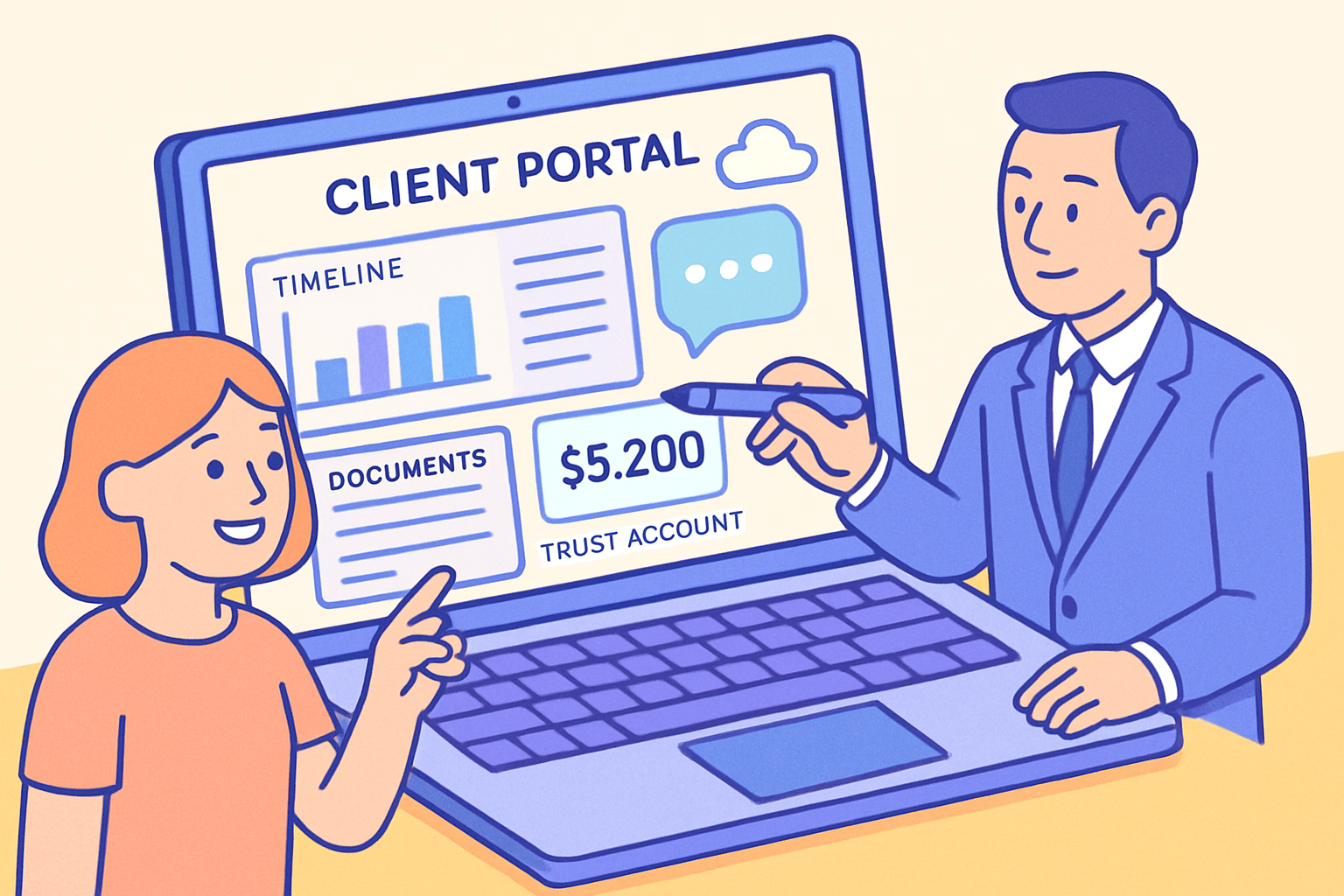

At The One Law Firm, we strive to create a community where legal professionals can come together to share their knowledge and expertise. Our blog will serve as a hub for case study analysis, best practices, and expert insights, providing practitioners with valuable tools to navigate the complexities of tax law.

Case Study Reviews

Our blog will feature detailed analyses of significant tax and revenue cases, highlighting key takeaways and practical lessons. We’ll break down complex tax decisions and explain their implications for both legal professionals and their clients.

Expert Insights and Industry Knowledge

Contributors to our blog will include seasoned tax professionals who bring decades of experience in navigating the ever-changing landscape of tax law. They will share their expertise, providing insights into the most effective strategies for addressing tax disputes, compliance issues, and complex transactions.

Collaborative Knowledge Sharing

As part of our blog community, you will have the opportunity to share your own case studies, strategies, and legal analyses. By contributing to the conversation, you will not only enhance your own practice but help to build a stronger, more informed tax law community.

Quote: “Contributing to the blog has been incredibly rewarding. Not only have I learned from others, but I’ve also had the chance to share my own experiences and help others avoid the mistakes I made early in my career.” — David Sims, Tax Partner at TaxPro Law.

The importance of case studies in Tax & Revenue law cannot be overstated. By examining the successes and failures of past cases, legal professionals can gain a deeper understanding of the law and improve their advocacy strategies. Engaging with The One Law Firm’s blog provides a platform for learning, sharing, and growing as a tax professional.

Contributing to the blog is a great way to give back to the legal community while strengthening your own professional reputation. By submitting your case studies, insights, and analyses, you’ll be helping to build a collective knowledge base that will benefit both you and your colleagues.

We believe that the key to success in Tax & Revenue law lies in understanding and applying the lessons learned from past cases. By engaging with our content, sharing your insights, and participating in the collaborative community at The One Law Firm, you will be better equipped to navigate the complexities of tax law. Join us today, contribute to the conversation, and help us build a stronger, more informed tax law community.

Endnotes

James Trenton, Partner at Tax & Revenue Law Associates.

Rachel Walker, Senior Tax Counsel at National Tax Consultants.

David Sims, Tax Partner at TaxPro Law.

On the last day of the Supreme Court’s 2023 term, a controversy over a wedding website that didn’t even exist set a pivotal precedent. In

How a pet‑food lawsuit became the Supreme Court’s cleanest answer yet to a messy removal problem—and what it means for every litigator who plays the

How a herring boat fight rewired U.S. administrative law—and what it means for agencies, regulated industries, and your litigation strategy. On a Friday morning at

How an unpublished Massachusetts opinion is quietly rewriting the rules of fiduciary warfare—and what every planner, litigator, and trustee should learn from the fallout. The

By TheOneLawFirm.com **“The express purpose of [§ 208(9)(o)] was to eliminate tax loopholes concerning royalty payments.” — Judge Cannataro, *Matter of Walt Disney Co.*¹ Long before Disney+ ever streamed a pixel in

How Adolph v. Uber Re‑wired California’s “Sue‑Your‑Boss” Law—and Why Labor Lawyers Everywhere Should Care By TheOneLawFirm.com “An order compelling arbitration of the individual claims does