By The One Law Firm

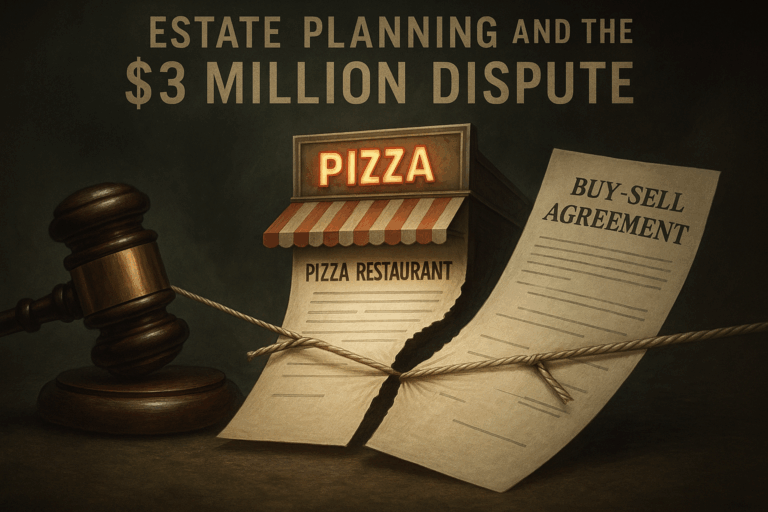

When Thomas Connelly buried his brother, he also found himself defending their family’s legacy—a closely held corporation whose fate hinged on a single life insurance policy. What followed was a tax dispute that exploded into a legal landmark, and every trust and estate attorney, tax advisor, and business succession planner in the country is now paying attention.

The Supreme Court’s 2024 decision in Connelly v. United States didn’t just close a circuit split. It rewrote the rules for estate tax valuation, especially where life insurance-funded buy-sell agreements are involved.

📂 The Business Owner’s Dilemma: What Is My Company Worth When I Die?

Crown C Supply, the Connelly brothers’ business, used a corporate-owned life insurance policy to fund a stock redemption agreement—a standard estate planning strategy for family businesses. When Michael Connelly passed away, the company received $3.5 million in insurance proceeds and used $3 million to buy back his shares from his estate.

Michael’s estate filed a return valuing his 77% ownership at $3 million. But the IRS said, not so fast: that insurance money still increased the fair market value of the business. The estate should have included it in its gross estate valuation—triggering nearly $900,000 in additional estate taxes.

And the U.S. Supreme Court agreed.

🧾 Visual Case Brief: Connelly v. United States

| Case | Connelly v. United States, 602 U.S. ___ (2024) |

|---|---|

| Court | U.S. Supreme Court |

| Key Legal Issue | Inclusion of life insurance in valuation of closely held business interests for estate tax |

| Ruling | Life insurance proceeds used for stock redemption must be included in valuation |

| Practice Areas Affected | Estate & Gift Tax Law, Trusts & Estates, Corporate Law |

| Outcome | Estate owed nearly $1 million in additional estate taxes |

🧠 The Supreme Court’s Ruling: Redemption ≠ Discount

Writing for a unanimous Court, Justice Clarence Thomas delivered a clear message: when calculating the fair market value of a decedent’s interest in a closely held business, life insurance proceeds received by the corporation—even if used to redeem the decedent’s shares—must be counted as an asset.

“A fair-market-value redemption has no effect on any shareholder’s economic interest.”

— Supreme Court Opinion, Connelly v. United States

Why? Because the valuation occurs at the moment of death—not after redemption. A willing buyer would value the business with the life insurance in its coffers, even if it’s earmarked for redemption.

This decision resolved a longstanding conflict between the Eighth Circuit and the Eleventh Circuit’s earlier opinion in Estate of Blount v. Commissioner, and sets a national precedent for how courts—and the IRS—approach life insurance in estate tax cases.

📊 Table: Estate Tax Valuation Before and After Connelly

| Estate’s Position | IRS / Supreme Court | |

|---|---|---|

| Business (excluding insurance) | $3.86M | $3.86M |

| + Life Insurance Proceeds | $0 | $3.0M |

| = Total Valuation | $3.86M | $6.86M |

| Estate’s Ownership (77%) | $3.0M | ~$5.3M |

| Additional Estate Tax Owed | $0 | ~$890,000 |

💼 Analysis: What Connelly Means for Estate Tax Attorneys & Succession Planners

This ruling will ripple through estate tax litigation, business succession planning, and trust and estate law for years to come. Here’s how:

1. 🔁 Buy-Sell Agreements Must Be Reevaluated

Attorneys who draft stock redemption agreements should immediately review whether life insurance proceeds are structured to trigger unwanted estate tax inclusion.

Legal takeaway: Corporate-owned policies used for redemptions will inflate the taxable estate of a deceased shareholder—even if the payout is contractually obligated.

2. 🧾 Cross-Purchase Agreements: The Preferred Strategy

Under a cross-purchase agreement, individual shareholders own life insurance policies on each other. When one dies, the proceeds go directly to the survivor—not the company—avoiding inclusion in the business valuation.

This strategy is increasingly favored post-Connelly, especially for two-owner businesses.

“If you want to keep estate taxes manageable, get the insurance out of the company.”

— Leading Estate Planning Attorney, NY

3. 🏦 ILITs and Insurance Trusts on the Rise

Attorneys are now leaning heavily on Irrevocable Life Insurance Trusts (ILITs) to insulate life insurance from both corporate value and estate inclusion. Trust-owned insurance avoids triggering §2042 and shields families from surprise tax bills.

📉 The Snapshot Rule: Why Timing Matters

The Supreme Court emphasized that estate tax valuation is a snapshot taken at the time of death. That’s critical:

-

Even if a buy-sell agreement mandates a redemption,

-

Even if the insurance money will be spent immediately,

-

If it’s in the company’s account at the moment of death, it’s taxable.

Practice pointer: Train clients to understand valuation timing, and structure agreements to control what’s “on the books” at death.

🧮 Legal Practice Areas Impacted

| Area of Practice | Impact of Connelly |

|---|---|

| Trust & Estate Planning | Must reevaluate entity-owned life insurance in succession plans |

| Estate Tax Litigation | Establishes bright-line rule on corporate insurance inclusion |

| Business Law / M&A | Changes valuation approaches in shareholder agreements |

| Tax Law | Redefines interplay of §§ 2031, 2042, and 2703 |

🏁 Final Takeaway: A New Playbook for Trust & Estates Law

The Supreme Court didn’t just rule on a technicality. It issued a wake-up call to every estate planner and buy-sell agreement attorney in the country.

Life insurance isn’t neutral if it flows through the company. The way business owners structure their agreements—and where they place their policies—can have millions of dollars in tax consequences.

“The Connellys did what everyone tells you to do: fund your buy-sell. The problem was how they did it.”

— Estate Planning Thought Leader, WealthCounsel™ Member

📌 Endnotes

-

Connelly v. United States, 602 U.S. ___ (2024).

-

Internal Revenue Code §§ 2031, 2042, 2703.

-

Eastern District of Missouri Summary Judgment Opinion.

-

U.S. Court of Appeals for the Eighth Circuit, Connelly opinion.

-

Estate of Blount v. Commissioner, 428 F.3d 1338 (11th Cir. 2005).

-

National Law Review, “SCOTUS Clarifies Estate Valuation Rules,” June 2024.

-

WealthManagement.com, “Post-Connelly Estate Planning Strategies,” July 2024.

-

Bloomberg Law, “Buy-Sell Agreement Structuring After Connelly,” July 2024.

-

IRS Estate Tax Examination Manual, 2024 Edition.