By TheOneLawFirm.com

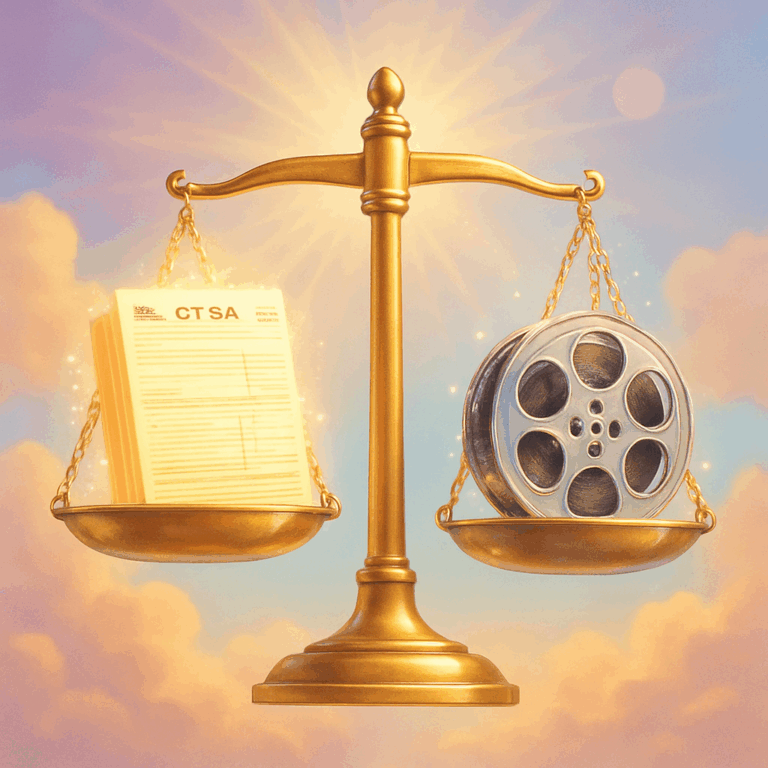

**“The express purpose of [§ 208(9)(o)] was to eliminate tax loopholes concerning royalty payments.” — Judge Cannataro, *Matter of Walt Disney Co.*¹

Long before Disney+ ever streamed a pixel in the Empire State, Walt Disney Co. and its foreign affiliates were starring in a very different saga—one that pitted Hollywood accounting against New York’s iron‑willed Tax Department. The episode came to a series finale on January 21, 2025 when the U.S. Supreme Court declined to grant certiorari, sealing a precedent that will reverberate through every boardroom still milking IP licensing deals.

At stake: whether royalties that zigzag across borders can dodge state franchise tax when the payor never files a New York return. The answer, says the Court of Appeals—and now, implicitly, the Supreme Court—is a resounding no.

❖ Case Brief (Just the Facts)

| Item | Details |

|---|---|

| Caption | Matter of Walt Disney Co. & Consol. Subsidiaries (No. 34) & IBM & Combined Affiliates (No. 35) |

| Court & Date | N.Y. Court of Appeals, Apr. 23 2024 |

| Issue #1 | Does former Tax Law § 208(9)(o)(3) let a parent deduct royalties received when the payor never “added back”? |

| Issue #2 | If not, does that condition flunk the dormant Commerce Clause? |

| Holding | Deduction denied; statute constitutional |

| Vote | 5‑0‑1 (Judge Cannataro for the Court; concurrence by C.J. Wilson) |

| Final Word | SCOTUS cert. denied Jan 21 2025 |

Table 1: Visual case brief

The Backstory: How a “Loop‑Closing” Statute Got Tested

Throughout the 2000s, multinationals perfected a move straight from the Sorcerer’s Apprentice:

-

Step 1 Park valuable IP in a low‑tax affiliate (often offshore).

-

Step 2 License that IP back to U.S. operating entities.

-

Step 3 Claim a deduction for outbound royalties, leaving the income untaxed anywhere in the U.S.

New York’s 2003 royalty add‑back regime sought to break the spell by forcing a payer to add those royalties back into its tax base—unless the group filed a combined report or the royalties were re‑routed to a third‑party commercial licensor. Simultaneously, it offered a mirror‑image deduction to the royalty recipient, but only if the payer had really done the add‑back on a New York return.

Disney and IBM argued that wording in § 208(9)(o)(3) (“unless such royalty payments would not be required to be added back”) meant they could still deduct even when their foreign affiliates never filed in New York. Albany’s auditors called that interpretation “fantasyland.”

The Court’s Two‑Step Analysis

-

Plain Language Wins

The Court of Appeals read “unless” in the deduction clause as a bright‑line gatekeeper: no actual add‑back, no deduction. Any other reading, Judge Cannataro warned, would “perpetuate the very loophole the Legislature sought to close.”¹ -

Commerce Clause Survives

Disney leaned on Kraft and Wynne, claiming the rule punishes cross‑border structures. The Court sidestepped the rhetoric and applied the internal‑consistency test: if every state enacted the same rule, the income would still be taxed only once at the group level. No facial discrimination, no double‑tax—case closed.¹

Chief Judge Wilson’s concurrence hammered the point home: this is a filing requirement, not economic protectionism. By anchoring liability to “taxpayer status” rather than geography, New York threaded the constitutional needle.

“Season 2” at One First Street—Cancelled

When Disney and IBM petitioned the U.S. Supreme Court, SALT watchers braced for a blockbuster. Instead, on **January 21 2025, the Court typed a one‑line order: “Petition DENIED.”**² ³ The denial leaves the New York opinion untouched and hands other states a how‑to manual for resilient add‑back laws.

Why Tax Pros Should Care

| Impact Zone | What Just Happened | What To Do Next |

|---|---|---|

| Open NY Audits (2003‑12) | ~$70 million already assessed; more in pipeline. | Re‑price reserves, consider closing agreements. |

| Royalty‑Holding Companies | Deduction benefit is a dead letter unless payor files in NY. | Re‑locate IP to U.S. entities inside combined groups or pivot to cost‑sharing. |

| Multi‑State Analogues | 20+ states still run royalty add‑backs; Disney is now prime authority. | Stress‑test models in NJ, MA, GA, CT, etc. |

| ASC 740 / FIN 48 | “Remote” uncertainty shifted to “probable” exposure overnight. | Reverse benefits, update rate recs. |

| Future SALT Litigation | Court embraced a “group‑level neutrality” framing. | Craft challenges that show real in‑state favoritism, not just filing friction. |

Table 2: Practitioner action grid

The Bigger Picture: IP’s Tax Future After Disney

The Bigger Picture: IP’s Tax Future After Disney

-

States Smell Blood

With a court‑tested formula, expect renewed legislative pushes to drag cloud receipts, streaming, and even NFT royalties into the add‑back orbit. -

Federal Pre‑emption Rumblings

Trade groups like COST allege a “patchwork nightmare” and lobby for a congressional safe harbor on foreign royalty income. Whether Capitol Hill bites remains uncertain, but Disney ratchets up the pressure.⁴ -

Global Intangible Low‑Taxed Income (GILTI) Collisions

As more states fold GILTI into their bases, multinationals must map overlapping rules: federal GILTI inclusion + state royalty add‑back could mean IP income takes a double hit unless structures adapt.

Final Take

Disney’s loss is a lawyer’s lesson: text and intent still matter, and clever entity charts can’t outrun a legislature determined to close an old loophole. The Commerce Clause isn’t a get‑out‑of‑tax‑free card when the statute taxes the same dollar exactly once somewhere. For now, multinationals licensing IP should assume the magic carpet ride is over—at least within New York’s borders.

Cue end‑credits music.

Endnotes

-

Matter of Walt Disney Co. & Consol. Subsidiaries v. N.Y. Tax Appeals Tribunal, 2024 NY Slip Op 02127 (N.Y. Ct. App. Apr. 23 2024) New York State Unified Court System

-

U.S. Supreme Court Docket No. 24‑333, The Walt Disney Co. v. N.Y. Tax Appeals Tribunal (entry dated Jan 21 2025) Supreme Court

-

SCOTUSblog, “The Walt Disney Co. v. New York Tax Appeals Tribunal—Petition for certiorari denied” (Jan 21 2025) SCOTUSblog

-

Andrea Muse, “SCOTUS Rejects New York Royalty Exclusion Challenge by Disney, IBM,” Tax Notes (Jan 22 2025) Hodgson Russ

-

Justia Opinion Summary for Matter of Walt Disney Co. (accessed Aug 7 2025) Justia

© 2025 TheOneLawFirm.com — This article is for informational purposes only and does not constitute legal advice.