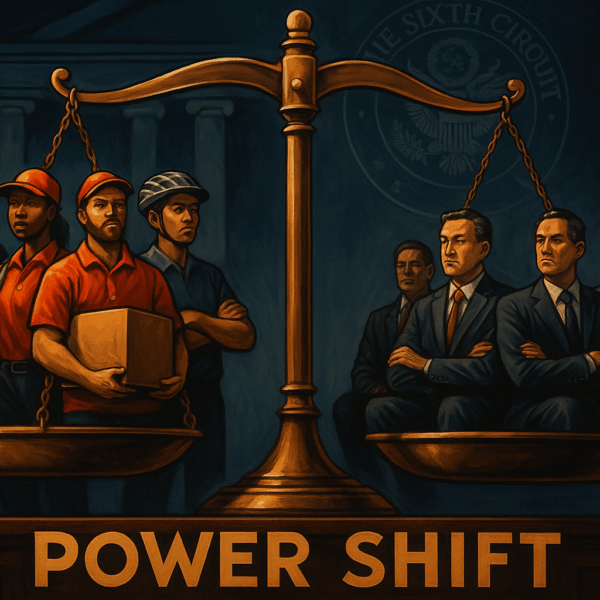

How a Sixth Circuit Pizza‑Driver Case Could Rewrite Reimbursement Rules for the Entire Gig Economy

“We respectfully disagree with both courts—and vacate their decisions.”

—Judge Raymond Kethledge, Parker v. Battle Creek Pizza, March 12 2024

When a federal appellate panel nukes both sides of a debate, the tremors tend to travel. That’s exactly what happened in Parker v. Battle Creek Pizza (consolidated with Bradford v. Team Pizza), a Sixth Circuit decision that junked the two most common ways employers repay workers who drive their own cars: the IRS standard‑mileage rate and the “reasonable approximation” beloved by finance departments. Instead, the court demanded nothing short of 100 percent, driver‑by‑driver reimbursement of actual costs.

On its face, Parker is a skirmish about pie delivery. In practice, it’s a constitutional‑sized slice of the $1 trillion U.S. logistics‑and‑mobility economy—from Instacart shoppers to home‑health aides—because it reimagines what the Fair Labor Standards Act (FLSA) means by wages paid “free and clear.” The ruling arrives just as inflation, rising insurance premiums, and a record $82‑cent‑per‑mile ownership cost have turned personal vehicles into black holes of worker debt.

Below, a guided tour through the legal labyrinth, complete with detours into automotive economics, regulatory infighting, and the data fueling plaintiffs’ new favorite class action.

A 60‑Second Case Brief (clip‑and‑save)

| Item | Details |

|---|---|

| Caption | Parker v. Battle Creek Pizza, Inc. & Bradford v. Team Pizza, Inc. |

| Court / Date | U.S. Court of Appeals, Sixth Circuit / March 12 2024 |

| Issue | Does paying minimum‑wage drivers less than their actual vehicle expenses violate § 531.35’s “free‑and‑clear” rule? |

| Ruling | Yes. Reimbursement must cover 100 % of each employee’s out‑of‑pocket costs; neither the IRS rate nor a bulk “reasonable approximation” suffices. |

| Result | District judgments vacated; cases remanded with instructions to develop evidence of individualized costs. |

| Ripple | Creates split with Eleventh Circuit district courts and contradicts a 2020 DOL opinion letter. |

Why the Sixth Circuit Torched “Reasonable Approximation”

-

Statutory text – “Each employee” must receive minimum wage after accounting for any “kick‑backs.” In the panel’s view, an under‑reimbursed mile is literally a negative wage.

-

Regulatory mismatch – Section 778.217 (overtime regs) might tolerate approximations, but § 531.35 (minimum‑wage regs) does not.

-

Data skepticism – The IRS mileage rate is a national average; gas in rural Kentucky isn’t gas in downtown Detroit. Precision matters when pennies decide FLSA liability.

-

Burden‑shifting nudge – The court floated a Title VII‑style framework: once a driver shows shortfall, employer must justify its math.

Translation: any company that pays at or near the $7.25 floor now owns a forensic‑accounting obligation for every tank of gas, quart of oil, and set of brake pads.

The Math Problem Employers Can’t Ignore

| Reimbursement Benchmark (2025) | Cents / Mile | Annual Shortfall for a 15k‑Mile Driver* |

|---|---|---|

| Actual Cost (AAA average) | 82¢ | $0 |

| IRS Standard Mileage Rate | 70¢ | –$1,800 |

| Common Pizza‑Chain “Run fee” | 28–33¢ | –$7,350 |

*Assumes 15,000 work miles.

The AAA figure is an 11‑cent jump in two years; insurance alone spiked 29 percent in 2024. Those deltas feed plaintiffs’ damages models—and make flat fees look prehistoric.

Collision Course: Sixth Circuit vs. Everyone Else

| Forum | Rule Today | Who’s Winning |

|---|---|---|

| Sixth Circuit (KY, MI, OH, TN) | Actual costs mandatory | Drivers |

| Northern Dist. of Alabama (11th Cir.) | Approximations OK; relies on DOL 2020 letter (Allen v. PJ Cheese) | Employers |

| DOL Wage‑Hour Division (Opinion FLSA2020‑12) | IRS rate or any “reasonable approximation” is compliant | Employers |

| IRS | Raises business rate to 70¢ for 2025—still 12¢ shy of AAA’s cost curve | Tie |

Result: a doctrinal traffic jam begging for Supreme Court GPS—or at least a DOL rulemaking that chooses a lane.

Voices From the Field

“Our clients have begun issuing telematics‑based pay stubs—every quart of oil depreciation is itemized like a phone bill.”

—Plaintiffs’ counsel, Gupta Wessler (speaking at NELA 2025)

“We’re in the pizza business, not the fleet‑management business. If the rule is ‘actual cost,’ we’ll bring the cars in‑house or raise menu prices.”

—COO, Midwest franchise group (background interview)

Strategic Playbook for 2025

| If You’re… | Do This Now |

|---|---|

| Corporate counsel | Deploy mileage‑tracking apps (Motus, Everlance). Benchmark reimbursements against local fuel + insurance indices, not national averages. |

| Plaintiffs’ bar | Use Parker to pry open discovery on cost data; push for class certification on uniform under‑reimbursement practices. |

| Policy wonk | Watch for a Wage‑Hour NPRM. Business lobby is pushing for a safe‑harbor mileage rate keyed to regional Consumer Price Index. |

| Gig‑platform ops | Model revenue impact under an 82¢ baseline; consider switching low‑density delivery zones to company‑owned EV fleets. |

The Broader Stakes

Nearly 174,000 new pizza‑driver jobs are projected this decade, and the broader driver‑sales workforce should grow 9 percent—well above the national average. Yet turnover remains brutal, fueled by wage theft suits that allege drivers end up netting $2–$4 an hour after expenses. If Parker stands, it reshuffles that calculus overnight. Some franchisors have already announced California‑wide driver layoffs; others are experimenting with third‑party apps that classify workers as contractors—inviting a different legal storm.

Bottom line: mileage reimbursement is no longer payroll trivia. It’s the canary in the coal mine for how courts will police employer cost‑shifting in an era of algorithmic scheduling and $5‑a‑gallon gasoline.

Can the Supreme Court stomach another employment split? With district courts in open rebellion and the Department of Labor on the opposite side of the Sixth Circuit, a cert petition seems inevitable. Until then, every mile is potential class‑action fodder—so buckle up.

Endnotes

-

Parker v. Battle Creek Pizza, Inc. & Bradford v. Team Pizza, Inc., 95 F.4th 1009 (6th Cir. 2024) Justia

-

29 C.F.R. § 531.35 (the “free‑and‑clear” rule). Legal Information Institute

-

AAA, Your Driving Costs 2024 fact sheet (average 82¢ per mile at 15k miles). AAA Newsroom

-

IRS, Standard Mileage Rates 2025 (70¢ per business mile). IRS

-

Allen v. PJ Cheese, Inc., Memorandum Opinion, N.D. Ala. (June 7 2024). Justia

-

U.S. Dept. of Labor, Opinion Letter FLSA2020‑12 (Aug. 31 2020). DOL

-

Zippia Research, Pizza Delivery Driver Job Trends (projected 174k new jobs). Zippia

-

U.S. Bureau of Labor Statistics, Delivery Drivers & Driver‑Sales Workers, Occupational Outlook 2025. Bureau of Labor Statistics

-

Jackson Lewis, “Sixth Circuit Rejects Two Methods for Computing Workers’ Vehicle Expenses,” client alert (2024). jacksonlewis.com