Visual Brief: The Case at a Glance

| Element | Detail |

|---|---|

| Case | Toni 1 Trust v. Wacker, 413 P.3d 1199 |

| Court | Alaska Supreme Court |

| Year | 2018 |

| Issue | Trust situs vs. full faith and credit |

| Outcome | Alaska’s exclusive trust jurisdiction rejected |

| Impact | Redefined the limits of DAPT protections |

“Jurisdiction is determined by the law of the court’s creation. It cannot be defeated by the extraterritorial operation of a statute of another state.”

—Alaska Supreme Court, quoting Tennessee Coal

ACT I: The Rise of the Fortress Trust

Once upon a time in Alaska—land of glaciers, oil, and fiscal conservatism—a new financial product was born: the domestic asset protection trust (DAPT). These trusts promised to do what traditional American trust law had long refused: allow someone to place assets in a trust, benefit from them, and simultaneously shield those assets from their own creditors.

In the late 1990s, Alaska led the charge with legislation allowing self-settled spendthrift trusts, and soon other states like Nevada, South Dakota, and Delaware joined the competitive trust arms race. The crown jewel of Alaska’s DAPT law was a statutory clause that declared Alaska courts held exclusive jurisdiction over any disputes involving transfers to these trusts.

And so, the Toni 1 Trust was born—with the intention to benefit the settlor, but also to keep creditor hands off. Or so the trust’s creators believed.

ACT II: From Montana with Judgment

In 2007, Donald Tangwall sued William and Barbara Wacker in Montana. The case went south quickly—for Tangwall. The Wackers won counterclaims and secured significant judgments. Facing collection, Tangwall and his relatives quickly transferred Montana real estate into the Toni 1 Trust, an Alaska-based DAPT.

The Wackers cried foul. In Montana state court, they filed a fraudulent transfer suit against the trust. The court agreed, entering default judgments and authorizing sheriff’s sales of the trust property.

Tangwall struck back—not in Montana, but in Alaska. He claimed that Alaska law gave its courts exclusive authority to hear any disputes over the trust. Therefore, he argued, Montana’s judgments were void. What ensued was a multi-year legal saga stretching from the Big Sky Country to the Last Frontier, and even into federal bankruptcy court.

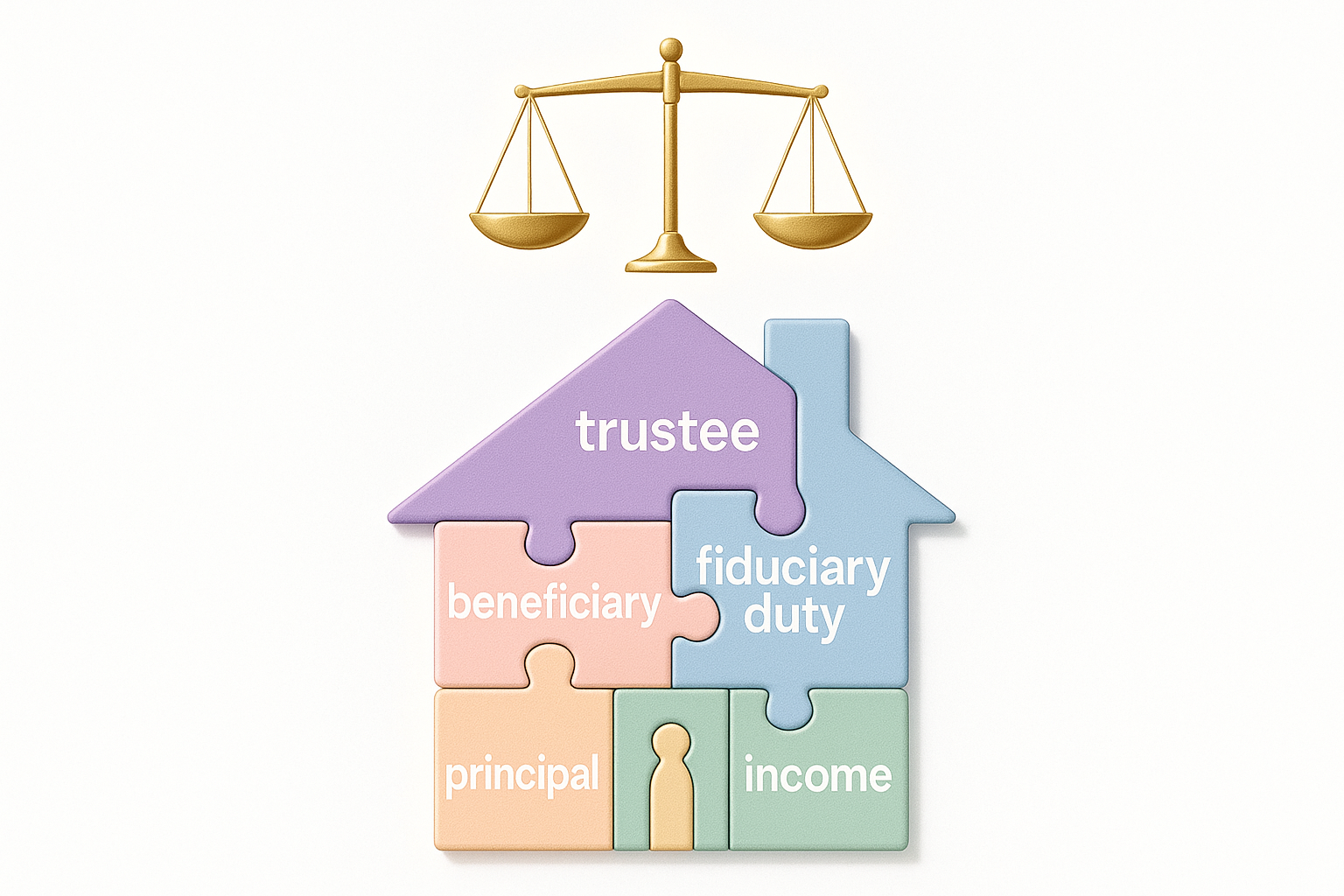

Sidebar: What is a DAPT?

| Feature | Description |

| Self-settled | Settlor can be a beneficiary of the trust |

| Spendthrift provisions | Creditors can’t compel distributions to satisfy debts |

| Situs state laws | Local statutes provide protection against claims |

| Controversy | Critics say DAPTs facilitate fraudulent transfers |

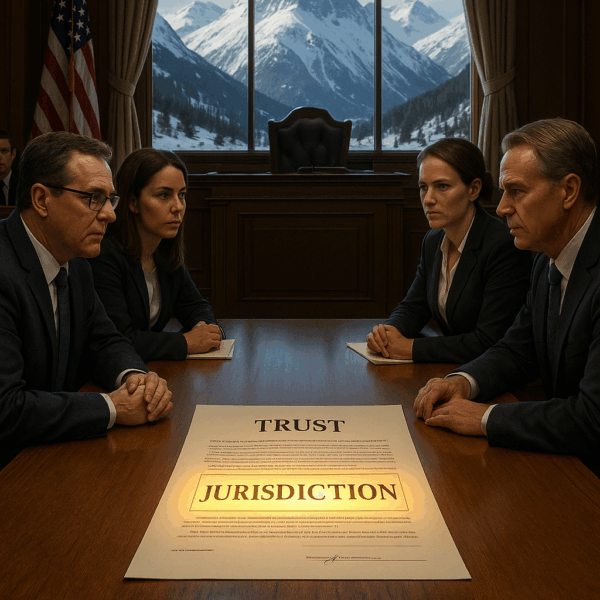

ACT III: Cracks in the Wall

When the case reached the Alaska Supreme Court in Toni 1 Trust v. Wacker, the justices were not buying what the trust was selling.

Tangwall’s argument leaned heavily on Alaska Statute 34.40.110(k), which said only Alaska courts could hear claims about Alaska DAPT transfers. But the court, quoting a 100-year-old U.S. Supreme Court case, held that no state can tell another how to run its courts.

The Montana court had jurisdiction over Montana real estate and parties in Montana. The Alaska law, the court ruled, could not override Montana’s power to apply its own laws. Even more damning for Tangwall, the federal bankruptcy court also had authority under federal law to address fraudulent transfers. State law can’t close federal courthouse doors.

Block Quote:

“AS 34.40.110(k) cannot prevent a Montana court from hearing a fraudulent transfer claim under Montana law, nor can it prevent a federal bankruptcy court from hearing such a claim under federal law.”

ACT IV: Aftershocks Across the States

The ruling sent tremors through the trust and estate planning world. For years, states like Alaska and Nevada marketed their trust laws as ironclad protection. Toni 1 Trust revealed those protections have a border.

The decision confirmed that:

-

Fraudulent transfers are transitory claims. Any court with personal jurisdiction can hear them.

-

Trust situs doesn’t equal jurisdiction. Where the assets and parties are matters just as much.

-

Bankruptcy courts apply federal law. State trust statutes cannot stop them.

And so, the “exclusive jurisdiction” clause in Alaska’s DAPT law? More aspiration than actuality.

Practice Tips: Asset Protection in a Post-Toni World

| Strategy | Why It Matters |

| Avoid fraudulent timing | Transfers post-judgment are red flags for courts |

| Centralize trust activity | Keep trustees, assets, and records in the situs state |

| Use local professionals | Institutional trustees in the situs can bolster credibility |

| Diversify planning tools | Use FLPs, LLCs, and exemptions in addition to DAPTs |

| Prepare for federal review | Bankruptcy courts won’t honor asset protection formalities |

ACT V: Not All Hope Is Lost

Should estate planners abandon DAPTs? Not necessarily. The Toni 1 case was extreme. Tangwall’s trust was hastily funded, post-judgment, with assets clearly connected to the judgment state.

Done right—with legitimate planning, independent trustees, and early formation—DAPTs may still offer a robust layer of protection. But they should be seen as part of a larger asset protection strategy, not a get-out-of-debt-free card.

Conclusion: A Wake-Up Call for Fortress Builders

In the end, Toni 1 Trust v. Wacker isn’t just about one man, one trust, or even one state. It’s about the limits of control in a federated legal system. No matter how aggressively one state legislates asset protection, its reach ends at its border.

And for practitioners, that means a recalibration is due. The fortress trust may still stand, but it is not impregnable.

Endnotes

-

Toni 1 Trust v. Wacker, 413 P.3d 1199 (Alaska 2018).

-

Alaska Stat. § 34.40.110.

-

Tennessee Coal, Iron & R.R. Co. v. George, 233 U.S. 354 (1914).

-

Marshall v. Marshall, 547 U.S. 293 (2006).

-

Marine Midland Bank v. Portnoy (In re Portnoy), 201 B.R. 685 (Bankr. S.D.N.Y. 1996).

-

In re Huber, 493 B.R. 798 (Bankr. W.D. Wash. 2013).

-

IMO Daniel Kloiber Dynasty Trust, 98 A.3d 924 (Del. Ch. 2014).

-

Cleopatra Cameron Gift Trust, 931 N.W.2d 244 (S.D. 2019).

-

11 U.S.C. § 548(e).

-

Uniform Voidable Transactions Act (UVTA), various state adoptions.