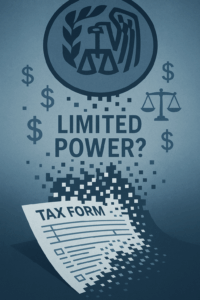

How a boutique advisor challenged the IRS’s regulatory muscle—and won.

The Case That Almost Wasn’t

If you blinked, you might have missed it: a 2021 Supreme Court case that quietly but decisively changed the rules for fighting back against the IRS. CIC Services, LLC v. Internal Revenue Service isn’t flashy. It has no billionaire defendant, no sensational scandal, and no massive corporate tax evasion scheme. But to tax litigators and administrative law nerds, it’s the kind of case that sets precedent, reshapes legal doctrines, and forces government agencies to play by the same rules as everyone else.

At its core, CIC Services is a story about a rule—a rather arcane IRS reporting requirement—and whether an advisor could challenge that rule before risking financial penalties or even jail time. What came out of the Supreme Court was not just a win for CIC Services, a boutique firm in Tennessee. It was a recalibration of the balance between taxpayers and the taxman.

Fast Facts: Visual Case Brief

| Case Name | CIC Services, LLC v. IRS |

|---|---|

| Citation | 593 U.S. ___ (2021) |

| Argued | December 1, 2020 |

| Decided | May 17, 2021 |

| Opinion by | Justice Elena Kagan |

| Holding | Pre-enforcement APA challenge to IRS rule not barred by AIA |

| Vote | 9-0 (Unanimous) |

The Regulatory Trigger: IRS Notice 2016-66

The story begins with IRS Notice 2016-66. This piece of regulatory guidance flagged certain “micro-captive” insurance arrangements as “transactions of interest” that required disclosure under the tax code. Think of micro-captives as risk management tools for small businesses that, in some circumstances, can double as tax shelters.

But the notice didn’t just flag these transactions. It demanded that both taxpayers and their advisors submit detailed disclosures to the IRS or face serious consequences: steep civil monetary penalties and even criminal sanctions for willful noncompliance.

Enter CIC Services, a consulting firm that helped clients design and manage these micro-captive insurance structures. Under Notice 2016-66, CIC was a “material advisor,” meaning it had to report client activities to the IRS and keep exhaustive records.

“The costs of compliance weren’t theoretical. They were immediate, tangible, and deeply burdensome.”

CIC filed a lawsuit seeking to block the IRS notice, arguing it violated the Administrative Procedure Act (APA) because it was issued without public notice or comment. The IRS, in turn, moved to dismiss the case, invoking the Anti-Injunction Act (AIA).

The Legal Battlefield: What’s the Anti-Injunction Act?

Here’s where things got tricky. The Anti-Injunction Act is a century-old statute that says you can’t sue the government to stop the collection of a tax. Instead, you have to pay the tax first and sue for a refund. It’s a cornerstone of federal tax enforcement, shielding the IRS from a flood of premature lawsuits.

The IRS’s argument: Since violating Notice 2016-66 triggered a tax penalty, any attempt to invalidate the rule was tantamount to restraining the collection of a tax. Therefore, barred.

The courts agreed. Both the district court and Sixth Circuit dismissed the case.

Supreme Strategy: Reframing the Fight

But CIC Services wasn’t done. On appeal to the Supreme Court, they took a different tack. Instead of focusing on the tax itself, they focused on the burden of compliance and the threat of criminal liability.

The Court’s Reasoning

Justice Kagan, writing for a unanimous Court, flipped the frame:

“This suit contests, and seeks relief from, a standalone reporting requirement, not a tax liability.”

The Court highlighted three key points:

-

Independent Regulatory Burden: The notice imposed obligations well before any tax was assessed.

-

Speculative Penalties: Penalties were contingent, not automatic.

-

Criminal Exposure: Refusing to comply could lead to criminal prosecution.

Therefore, CIC’s lawsuit was not trying to stop a tax. It was trying to stop an unlawful rule. Big difference.

Concurrences and Caveats

Justice Sotomayor filed a short concurrence noting that the case might be different if the plaintiff were a taxpayer rather than a third-party advisor. Justice Kavanaugh wrote separately to highlight the blurry line between regulatory taxes and regulations enforced by taxes.

| Key Takeaway from Kavanaugh |

| “Pre-enforcement review is allowed if a rule imposes independent duties and the tax penalty is incidental.” |

Strategic Implications for Legal Practitioners

The implications are enormous for tax advisors, compliance officers, and litigators alike.

When Can You Sue the IRS Early?

| Scenario | Can You Sue Pre-Enforcement? |

| Challenging a pure tax assessment | No |

| Challenging a regulatory rule enforced by tax penalty | Yes (sometimes) |

| Challenging a criminally enforceable rule | Yes (stronger grounds) |

Litigation Playbook

-

Focus on regulatory burdens, not tax avoidance.

-

Highlight criminal exposure if present.

-

Frame the suit as a procedural APA challenge, not a tax case.

Broader Impact: IRS Accountability and Administrative Law

-

CIC Services* has already inspired follow-on litigation. In Mann Construction, Inc. v. United States, the Sixth Circuit struck down another IRS notice for skirting APA requirements. Lower courts are now more willing to scrutinize IRS guidance that looks more like legislation than administration.

This decision also chips away at what some critics call “tax exceptionalism”—the idea that the IRS gets a pass on the procedural rules that apply to other federal agencies.

“CIC Services ensures that the APA matters, even when the IRS is involved.”

Final Thoughts: A New Chapter in Tax Litigation

-

CIC Services* doesn’t rewrite the entire tax code. But it does carve out a crucial space where pre-enforcement challenges to IRS rules can survive. It makes room for litigation before damage is done—before businesses must choose between compliance and criminal liability.

For legal professionals, it’s a signal: The courts are watching the IRS. And procedural shortcuts are no longer immune from challenge.

End Notes

-

CIC Services, LLC v. Internal Revenue Service, 593 U.S. ___ (2021).

-

Internal Revenue Code §6721 and §6671 classify civil penalties as taxes for enforcement purposes.

-

Notice 2016-66, IRS, Nov. 1, 2016.

-

Administrative Procedure Act, 5 U.S.C. §553.

-

National Federation of Independent Business v. Sebelius, 567 U.S. 519 (2012).

-

Florida Bankers Ass’n v. U.S. Department of the Treasury, 799 F.3d 1065 (D.C. Cir. 2015).

-

Mann Construction, Inc. v. United States, 27 F.4th 1138 (6th Cir. 2022).

-

Justice Elena Kagan, Opinion of the Court, CIC Services, 593 U.S. ___ (2021).

-

Justice Brett Kavanaugh, Concurring Opinion, CIC Services, 593 U.S. ___ (2021).

-

Justice Sonia Sotomayor, Concurring Opinion, CIC Services, 593 U.S. ___ (2021).

Written for TheOneLawFirm.com | Legal Analysis Division

Write something…